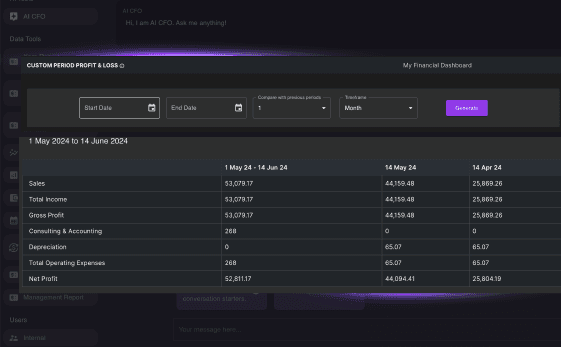

Startups need to track monthly spending to understand how long their funds will last, while established companies must forecast their financial status to plan for growth and funding needs. RyzUp’s AI-powered Profit & Loss forecasting tool delivers accurate, actionable insights, empowering you to make informed decisions and ensure your business's financial stability.

No credit card required

7 days free trial

Tested by the world’s fast growing startups

With just a few simple inputs RyzUp generates accurate and comprehensive P&L forecasts, allowing you to plan ahead with confidence. Here is how it will help you:

Frequent Updates

Founders and financial teams can view projections bi-weekly, monthly, or even weekly, allowing for timely decision-making.

Ease of Understanding:

Having accessible and understandable P&L forecasts helps in planning and adjusting strategies quickly.

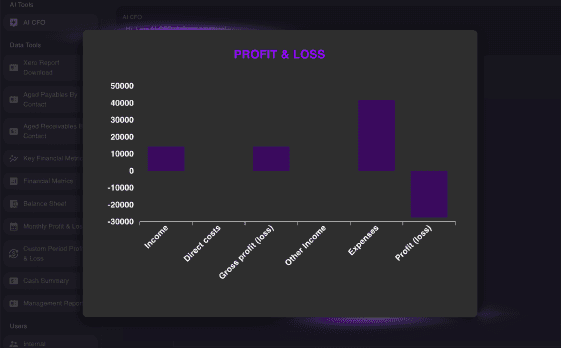

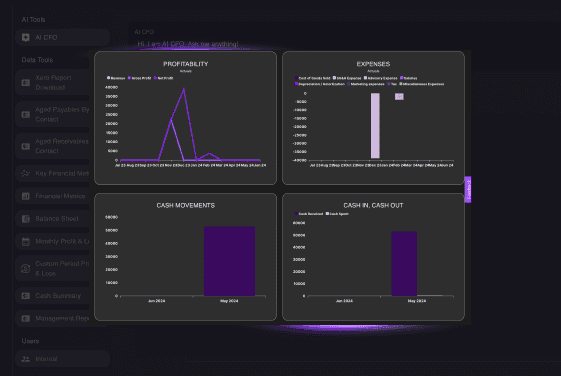

Expese Tracking

Monitor actual expenses to ensure budget compliance.

Categorize expenses for detailed financial analysis.

Highlight unexpected or unusual spending patterns.

Receive recommendations to optimize cost management.

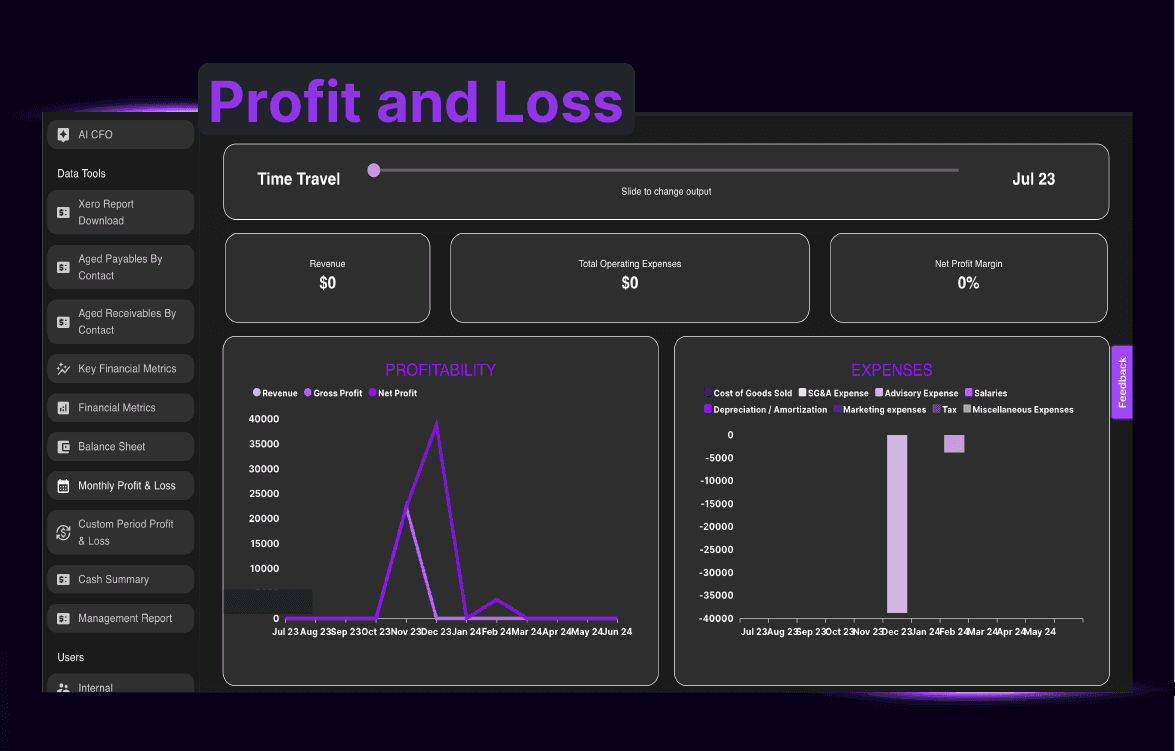

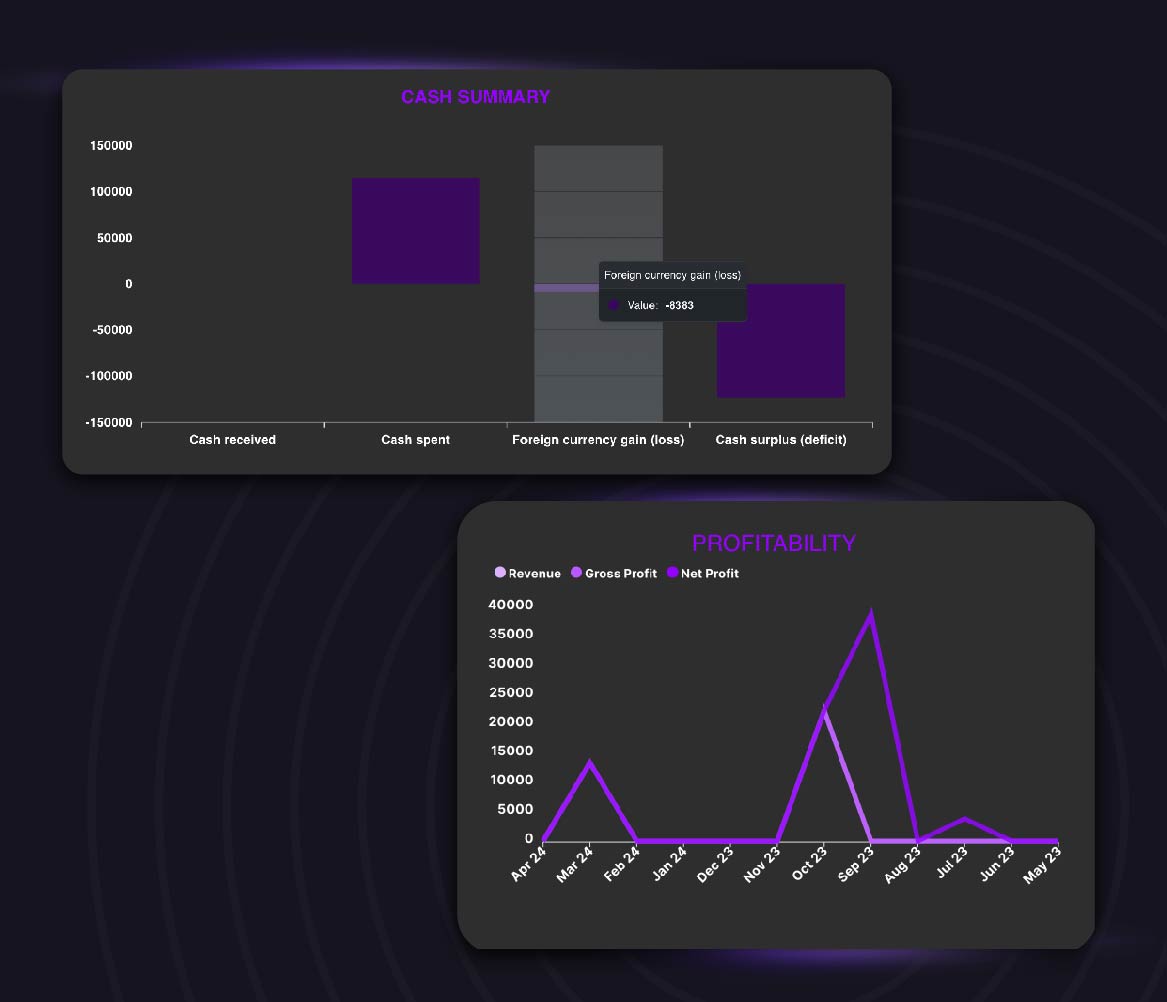

Visual Data Representation

RyzUp automates KFM tracking, giving you real-time visibility, trend analysis, and actionable insights.

CASH IN, CASH OUT

Get a detailed view of all cash inflows and outflows.

Identify major sources of cash and significant outflows.

Balance cash inflows with outflows to avoid deficits.

Use insights to optimize cash management strategies.

CASH BALANCE

Keep track of your current cash balance at all times.

Monitor changes in cash balance to maintain liquidity.

Ensure sufficient funds are available for short-term needs.

Plan for future investments with a clear view of available cash.

HISTORICAL REVENUE

Review revenue trends over specific periods.

Analyze historical revenue data to forecast future performance.

Identify seasonal patterns or recurring trends.

Use past data to set realistic revenue targets.

TOP 5 EXPENSES

Identify the top 5 expense categories for any custom period.

Analyze spending patterns to find cost-saving opportunities.

Compare current expenses against historical data.

Use insights to create more efficient budgeting strategies

What is P&L forecasting, and why is it important for my business?

P&L (Profit and Loss) forecasting involves predicting your business’s future income and expenses. It’s crucial for making informed financial decisions, planning for growth, and ensuring financial stability. Accurate P&L forecasts help identify potential financial challenges and opportunities, allowing you to strategize effectively.

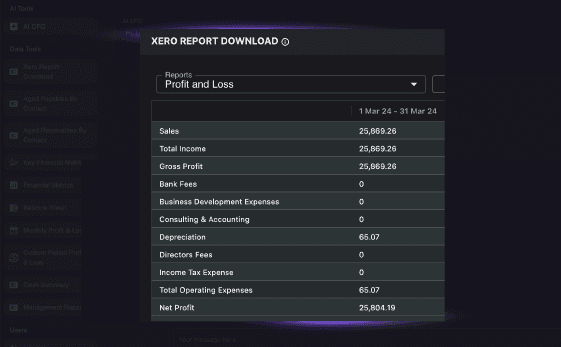

How does RyzUp's AI-powered P&L forecasting tool work? p integrate with?

Can RyzUp’s P&L forecasting tool handle different financial scenarios?

How often can I update my P&L forecasts with RyzUp?

What are the key benefits of using RyzUp's AI-powered P&L forecasting tool?

How does RyzUp ensure the accuracy of the P&L forecasts?

Can RyzUp's P&L forecasting tool be customized to fit my business's specific needs?

Join the many teams worldwide who trust Ryz Up to simplify their business finance and get on top of your cash flows